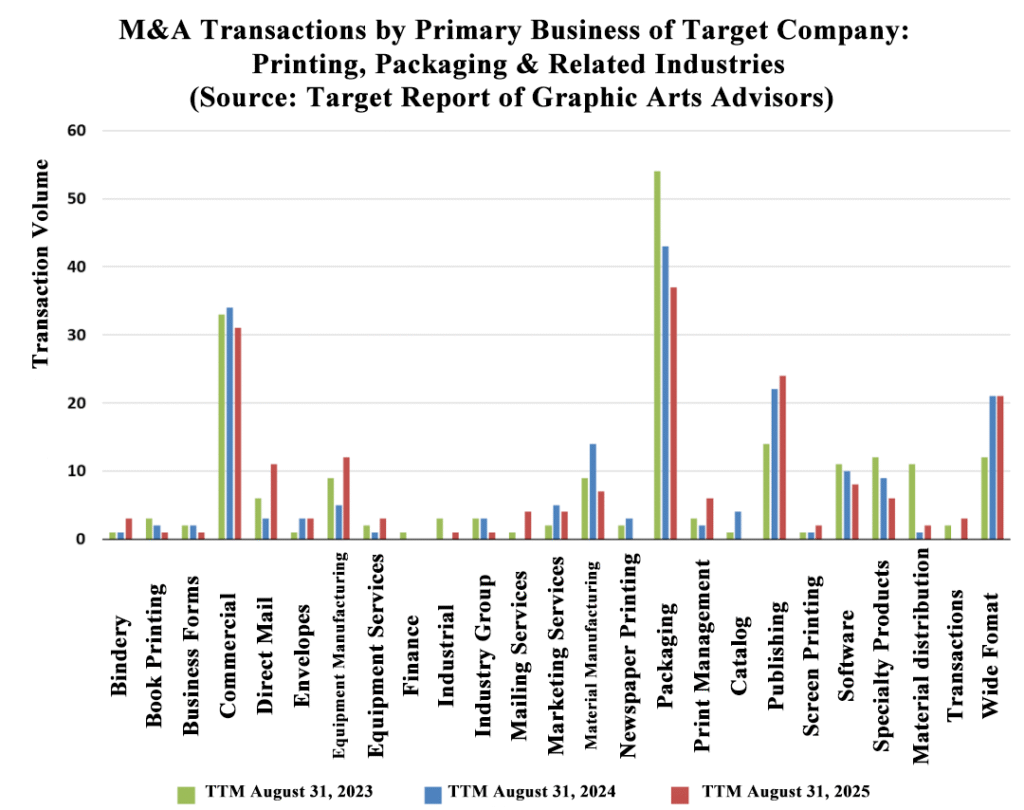

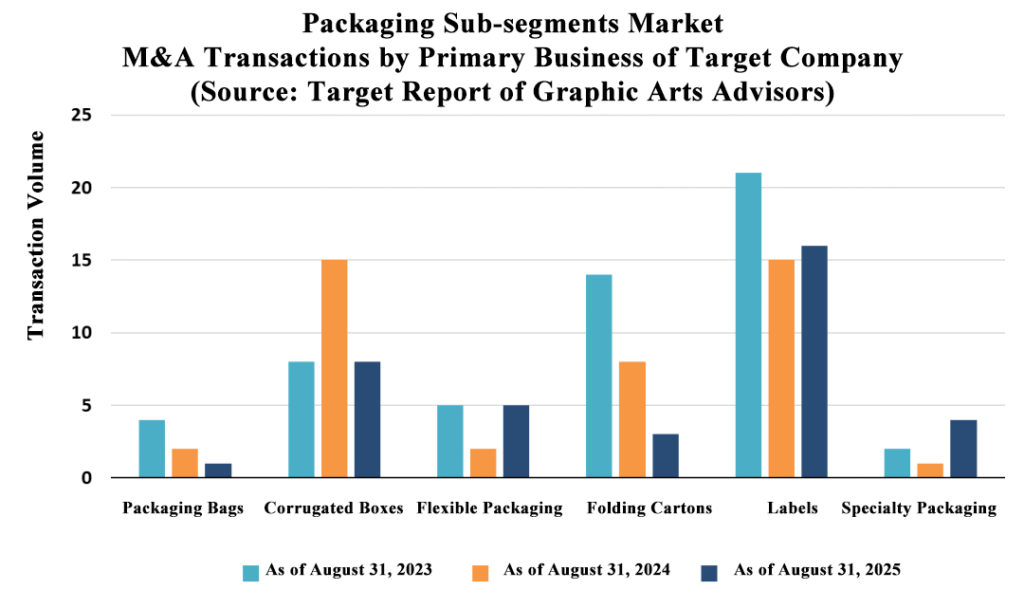

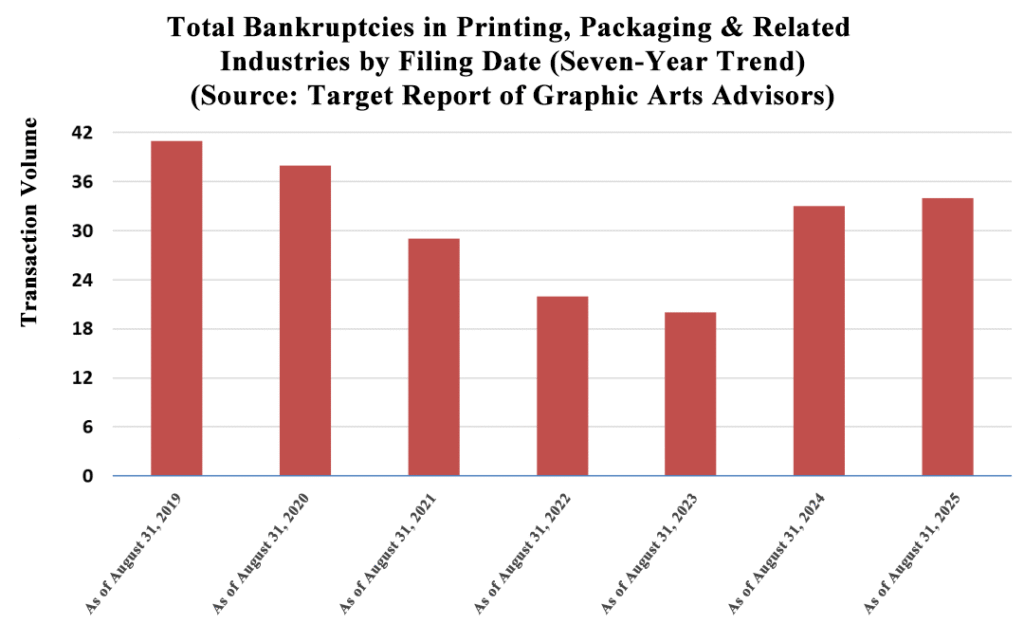

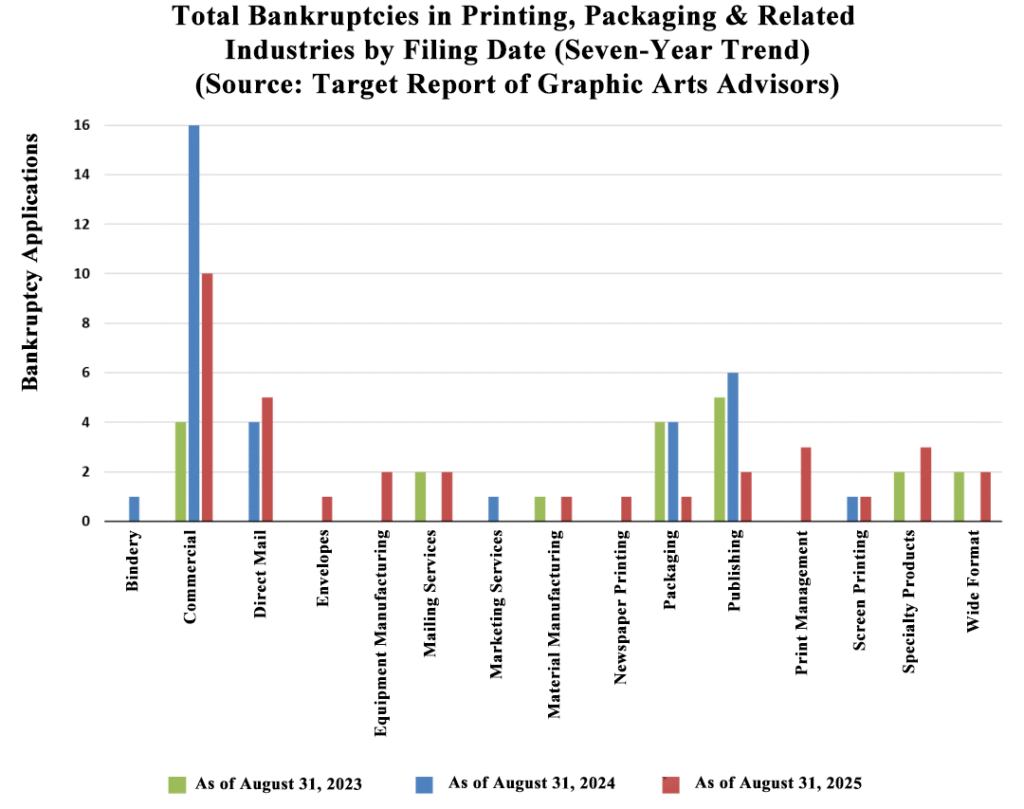

Graphic Arts Advisors (GAA) recently released the annual Merger & Acquisition (M&A) activity data, which covers commercial printing, packaging (labels, folding carton, flexible packaging), and wide-format graphics. The latest data, spanning the 12 months up to August 31, 2025, reveals an industry undergoing a significant structural shakeup, characterized by both sustained consolidation and a notable surge in distress.

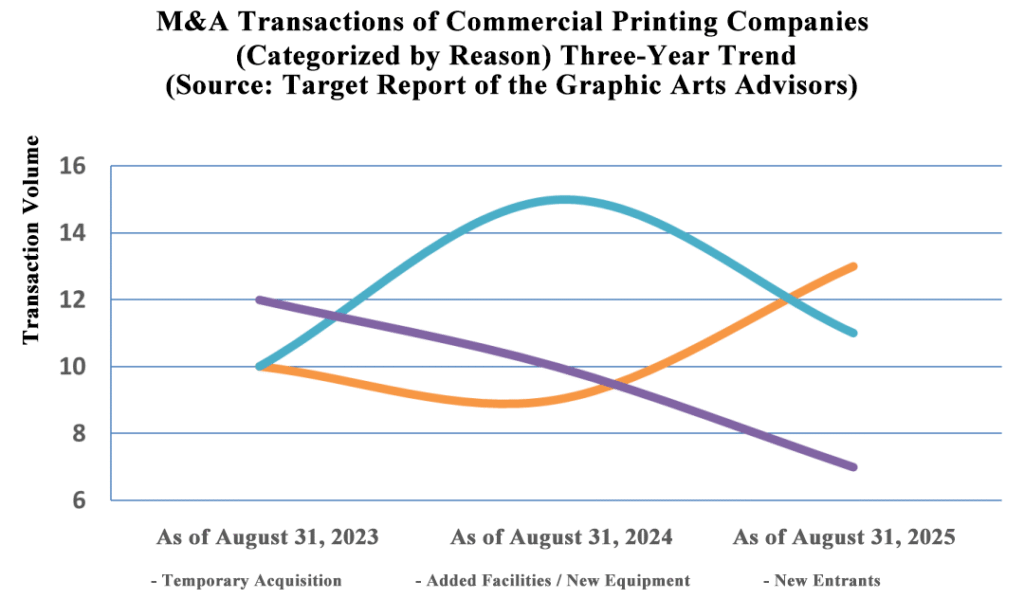

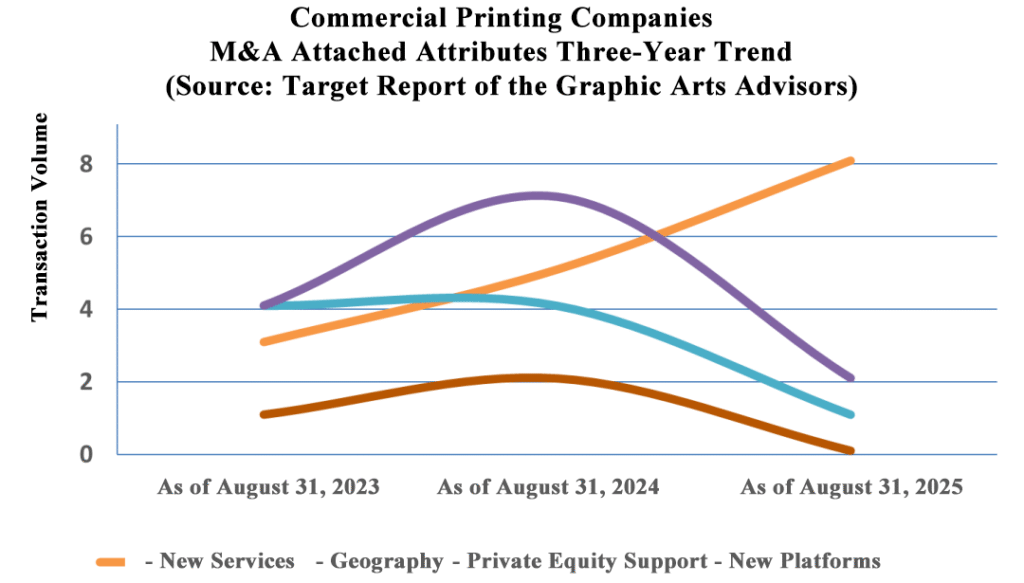

While the overall number of M&A transactions remains relatively stable, the underlying currents signal growing operational pressure, particularly in the commercial sector. The most striking indicators of this stress are the recent spikes in both bankruptcy filings and non-bankruptcy closures, hitting a near 13-year high.

1. M&A Activity: Stability Amid Declining Visibility

The GAA has been tracking M&A activity for fourteen years, providing crucial insights into the market’s future direction. The overall conclusion for the most recent period is that M&A volume is largely stable, but visibility is declining.

The total number of noteworthy M&A transactions recorded over the last 12 months (ending August 31, 2025) was 191. This represents only a minor 1.1% increase from the prior period and remains 12.4% below the 2022 peak. Since 2016, the current absolute transaction volume is near a low point. On a tactical level, the transaction cadence followed a typical pattern: activity peaked in January and then steadily declined, hitting its annual low point in July and August.

While the overall number of M&A transactions remains relatively stable, the underlying currents signal growing operational pressure, particularly in the commercial sector. The most striking indicators of this stress are the recent spikes in both bankruptcy filings and non-bankruptcy closures, hitting a near 13-year high.